The main purpose of auto insurance is to protect you from financial loss after an accident, theft, or unexpected vehicle damage. It shields your savings, covers your legal responsibility, and keeps one mistake from turning into long-term debt.

When you drive, you accept risk. Traffic congestion, distracted driving, severe weather, and uninsured motorists increase that risk daily. Auto insurance exists to absorb the financial impact when something goes wrong.

At Matrix Insurance Company, we’ve worked with drivers for over 25 years. One consistent pattern stands out: accidents are unpredictable, but financial protection is a choice.

Why Do States Require Auto Insurance?

States require auto insurance to ensure drivers can pay for the damage they cause.

If you injure someone or damage their property, liability coverage pays those expenses up to your policy limits. Without it, you would pay personally.

Most states require:

-

Bodily injury liability

-

Property damage liability

In no-fault states like Florida, the rules differ. If you want a deeper breakdown of required coverages under Florida law, this guide explains the two mandatory protections and how they function in real claims:

https://matrix-insurance.com/blogs/what-are-the-two-types-of-required-insurance-coverage-to-comply-with-floridas-no-fault-law/

Legal compliance is only one layer. The broader purpose involves protecting your financial foundation.

How Does Auto Insurance Protect You Financially?

Auto insurance transfers financial risk from you to the insurer.

Consider typical accident-related costs in the U.S.:

-

Minor collision repair: $1,000–$3,000

-

Moderate vehicle damage: $4,000–$10,000

-

Serious bodily injury claim: $20,000+

-

Multi-vehicle accidents: Often exceed $100,000

Few households can absorb those costs comfortably.

Insurance prevents sudden asset depletion. If you want a broader explanation of how coverage prevents financial instability, this article explains how insurance protects you from financial loss across different scenarios:

https://matrix-insurance.com/blogs/how-can-insurance-protect-you-from-financial-loss/

Now let’s break down what your auto policy actually includes.

What Does Auto Insurance Typically Cover?

A standard auto policy includes multiple protection layers.

1. Liability Coverage

Liability coverage pays for injuries and property damage you cause to others. It also covers legal defense costs if you are sued.

2. Collision Coverage

Collision coverage pays to repair or replace your car after an accident, regardless of fault.

If your vehicle is declared a total loss, understanding claim value becomes critical. This guide explains how to get the most money from insurance for a totaled car and how insurers calculate payouts:

https://matrix-insurance.com/car/how-to-get-the-most-money-from-insurance-for-totaled-car/

3. Comprehensive Coverage

Comprehensive coverage pays for non-collision events such as theft, vandalism, hail, falling objects, or fire.

4. Uninsured or Underinsured Motorist Coverage

This coverage protects you if the at-fault driver has little or no insurance.

For example, if you are uninsured but the other driver caused the accident, your options depend heavily on state law. This article explains what happens in that situation:

https://matrix-insurance.com/car/what-happens-if-you-have-no-insurance-but-the-other-driver-was-at-fault/

Each coverage type addresses a different risk category. Together, they form a structured safety net.

What Happens If You Drive Without Insurance?

Driving uninsured exposes you to severe financial and legal consequences.

You may face:

-

License suspension

-

Registration revocation

-

Fines and reinstatement fees

-

Personal lawsuits

-

Wage garnishment

Even when insurance pays a claim, how you handle those funds matters. For example, if you receive a claim payout but do not repair the vehicle, there can be financial and legal implications. This article explains what happens if you don’t use insurance money for repairs:

https://matrix-insurance.com/car/what-happens-if-you-dont-use-insurance-money-for-repairs/

Insurance exists to prevent long-term setbacks—not just to fix dents.

What Factors Affect Your Auto Insurance Premium?

Insurers calculate premiums using measurable risk indicators.

Common rating factors include:

-

Driving record

-

Age and experience

-

Vehicle make and model

-

ZIP code

-

Credit-based insurance score (where permitted)

-

Marital status

If you want a detailed explanation of what increases or decreases your premium, this breakdown explains each factor clearly:

https://matrix-insurance.com/car/what-factors-increase-or-decrease-your-car-insurance-premium/

Before purchasing coverage, many drivers prefer to estimate costs independently. You can calculate an approximate rate using tools like this car insurance calculator:

https://matrix-insurance.com/insurance-calculators/car-insurance-calculator/

Understanding pricing helps you choose coverage intentionally rather than reactively.

Is Minimum Coverage Enough to Protect You?

Minimum coverage satisfies state law, but it may not protect your assets.

Example:

-

Your liability limit: $25,000

-

Total damages caused: $60,000

-

Personal responsibility: $35,000

If you own property, savings, or investments, low limits expose those assets.

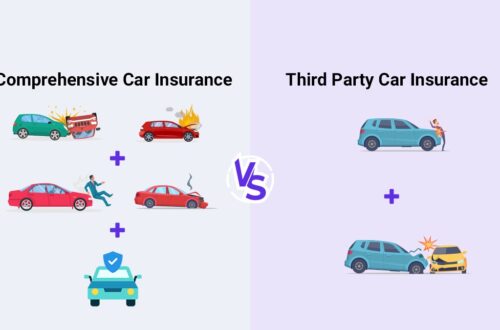

Comparing third-party liability coverage with comprehensive policies helps clarify the difference in protection levels. This cost comparison explains how coverage types differ in price and scope:

https://matrix-insurance.com/car/third-party-vs-comprehensive-insurance-cost-comparison/

Your coverage level should reflect your financial exposure, not just state minimums.

How Does Auto Insurance Support Long-Term Financial Stability?

Auto insurance supports financial stability by limiting catastrophic loss.

It:

-

Protects savings

-

Preserves credit

-

Reduces lawsuit risk

-

Keeps transportation accessible

-

Satisfies lender requirements

If you finance or lease your vehicle, your lender requires physical damage coverage because the car serves as loan collateral.

At Matrix Insurance Company, we have spent 25 years helping drivers align coverage with real-world risk. You can learn more about our team and background here:

https://matrix-insurance.com/about-us/

Insurance works as a structured risk management strategy. It converts uncertainty into predictable cost.

The Core Purpose in Simple Terms

The primary purpose of auto insurance is financial protection.

It protects:

-

Your income

-

Your savings

-

Your legal standing

-

Your vehicle

-

Your long-term financial stability

Accidents happen daily across the country. Financial devastation does not have to follow.

Auto insurance exists to make sure one event does not undo years of financial progress.