Imagine waking up one morning, walking to your driveway, and discovering your car is gone. Panic sets in. Now, imagine this scenario without any auto insurance to fall back on. The reality can be harsh, and understanding the consequences can save you from major financial headaches.

Financial Consequences of a Stolen Car Without Insurance

If your car is stolen and you don’t have auto insurance, the most immediate problem is financial loss. Cars depreciate over time, and replacing your vehicle out-of-pocket can cost thousands of dollars. Unlike having comprehensive coverage, which protects against theft, you would have no claim to recover your loss.

Matrix Insurance, with over 25 years of experience, emphasizes that comprehensive insurance can cover theft, fire, or vandalism. Without it, you’re fully responsible for the replacement cost. For insights on how insurance protects you from unexpected losses, check out how insurance can protect you from financial loss.

Out-of-Pocket Replacement Costs

Replacing a stolen vehicle without insurance means you must pay:

-

Market value of a similar vehicle: Depending on make and model, this could be $10,000–$50,000.

-

Taxes and registration fees: Often overlooked, these can add several hundred dollars.

-

Temporary transportation: Rental cars or rideshares while searching for a new car.

Even if you had a minimal budget car, the cost is still immediate and unavoidable.

Legal Implications of Driving Without Insurance

Many states legally require auto insurance. If your car is stolen, the absence of coverage might not directly cause legal trouble—but driving without insurance afterward will. In some regions, being uninsured could:

-

Lead to fines and penalties

-

Require SR-22 filings to prove future insurance

-

Affect your driver’s license status

Matrix Insurance offers guidance on what documents are needed to obtain coverage and avoid legal risks. For reference, you can see what you need to get car insurance.

When the Other Party Is at Fault

In some cases, if another driver steals your car or damages it during a theft-related incident, your recovery options depend on their insurance. Without your own insurance, you might need to file a claim directly against the other driver, which can be time-consuming and sometimes fruitless if they’re underinsured. Matrix Insurance explains these nuances in what happens if you have no insurance but the other driver was at fault.

Emotional and Practical Stress

Beyond money and legal issues, losing your car uninsured can create emotional stress. Cars are not just transportation—they’re tools for work, school, and daily life. Coping with sudden mobility loss affects:

-

Job commute and punctuality

-

School drop-offs or childcare responsibilities

-

Social commitments and errands

Having insurance would at least provide financial relief to replace or repair your car, reducing stress significantly.

How Insurance Can Save You from Theft Loss

Comprehensive auto insurance is designed specifically to protect against theft. Coverage typically includes:

-

Replacement of stolen vehicles at market value

-

Compensation for vandalism or fire

-

Rental car reimbursement while a claim is processed

Matrix Insurance explains how to maximize your insurance payout if your car is totaled or stolen in how to get the most money from insurance for a totaled car.

Tips to Minimize Theft Risk

Even with insurance, preventing theft is smarter than relying solely on claims. Consider:

-

Parking in well-lit, secure areas

-

Installing tracking devices or alarms

-

Keeping valuables out of sight

-

Locking doors and rolling up windows

Prevention reduces the likelihood of filing claims and can even lower premiums, as discussed in what factors increase or decrease your car insurance premium.

Alternatives if You Don’t Have Insurance

If you currently lack coverage and your car is stolen, consider:

-

Filing a police report immediately: Essential for potential recovery or insurance claims later.

-

Exploring financial assistance programs: Some banks offer short-term loans or emergency funds for vehicle replacement.

-

Purchasing insurance immediately: Even if it doesn’t cover the current theft, it protects you against future losses. Matrix Insurance provides clear steps on how to estimate car insurance costs for timely protection.

Building a Safety Net for the Future

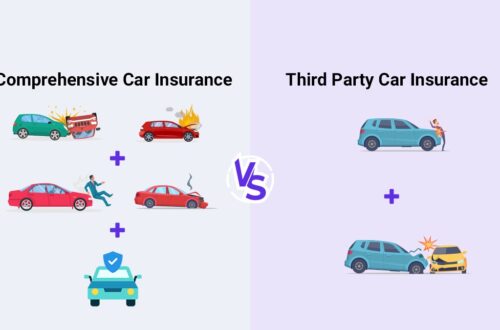

Being uninsured leaves you vulnerable. Matrix Insurance, operating for 25 years, stresses that comprehensive coverage paired with liability ensures both legal compliance and financial security. For example:

-

Liability insurance protects others if your car accidentally causes damage.

-

Comprehensive insurance covers theft, fire, and other non-collision losses.

For a deeper dive, learn the main purpose of having auto insurance.

A stolen car without insurance leaves you financially exposed, legally vulnerable, and stressed. Taking preventive steps, obtaining comprehensive coverage, and understanding your insurance options can prevent this nightmare scenario.