Car insurance calculators help drivers estimate premiums quickly. Yet many people use them incorrectly, leading to misleading results and costly decisions. In this guide, insurance expert Lori Wray, AAI, explains the most common mistakes and how to avoid them.

What is the role of a car insurance calculator?

A car insurance calculator estimates premiums based on vehicle details, driver history, and coverage choices. The tool provides a quick projection, but accuracy depends on the quality of the information entered.

You can try one directly through this car insurance calculator to see how your inputs affect premiums.

Mistake 1: Entering inaccurate personal or vehicle information

Most calculators rely on self-reported data. If you enter incorrect vehicle age, mileage, or usage, the estimate becomes unreliable. Lori Wray notes that even a small error, like underreporting annual mileage, can shift the premium significantly.

Example:

-

Entering 8,000 miles instead of 15,000 miles per year can reduce the quote by 15–20%, but insurers will correct it later.

Mistake 2: Ignoring coverage levels and policy options

A calculator only reflects what you select. Many users pick the lowest coverage just to see the cheapest price. This skews the estimate and hides the true cost of adequate protection.

Key overlooked options:

-

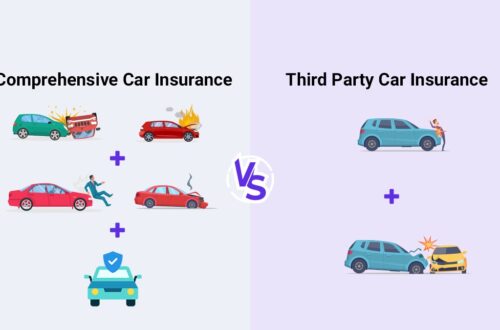

Comprehensive vs. liability-only coverage

-

Collision deductibles

-

Uninsured motorist coverage

-

Roadside assistance or rental reimbursement

Selecting the wrong combination gives a false picture of affordability.

Mistake 3: Not considering discounts and special programs

Car insurance calculators rarely show the full range of discounts. Drivers often miss out on savings because they assume the calculator’s number is final.

Discounts that calculators may skip:

-

Multi-policy bundling

-

Good student discounts

-

Safe driver telematics programs

-

Vehicle safety features

Lori Wray emphasizes that agents often apply multiple discounts that an online tool cannot predict.

Mistake 4: Forgetting to update life changes

Premiums change when your circumstances change. Calculators only work with the data you provide at the moment. Many users fail to update:

-

Address changes

-

New drivers in the household

-

Changes in commuting distance

-

Recent claims or tickets

This creates a gap between calculator results and real insurer quotes.

Mistake 5: Treating the calculator as a final quote

A calculator is an estimate, not a binding offer. People often mistake the number as guaranteed. Insurers adjust rates based on credit scores, prior claims, and underwriting factors not included in calculators.

Lori Wray advises using calculators as a starting point and then consulting an agent to verify accuracy.

How can you use car insurance calculators effectively?

To use a vehicle insurance calculator effectively, always:

-

Enter accurate and updated details.

-

Explore multiple coverage levels.

-

Ask an insurance advisor about discounts.

-

Recheck estimates after life changes.

-

Treat results as a guide, not a quote.

Why consult an insurance expert like Lori Wray, AAI?

Insurance tools are helpful, but they cannot replace professional expertise. Lori Wray, AAI, helps drivers interpret calculator results, compare policy options, and secure discounts. Her guidance ensures that coverage matches both budget and protection needs.

You can read more about her background here: Lori Wray, AAI.

One comment on “Top 5 Mistakes People Make With Car Insurance Calculators”