Car insurance is not only a legal requirement in most regions but also a financial safety net for drivers. The two most common policy types are third-party insurance and comprehensive insurance. Many drivers ask: Which option is more affordable and which provides better protection?

This guide breaks down cost differences, coverage details, and factors that influence premiums. Insights are supported by expert input from Lori Wray, AAI, an experienced insurance advisor.

What Is Third-Party Car Insurance?

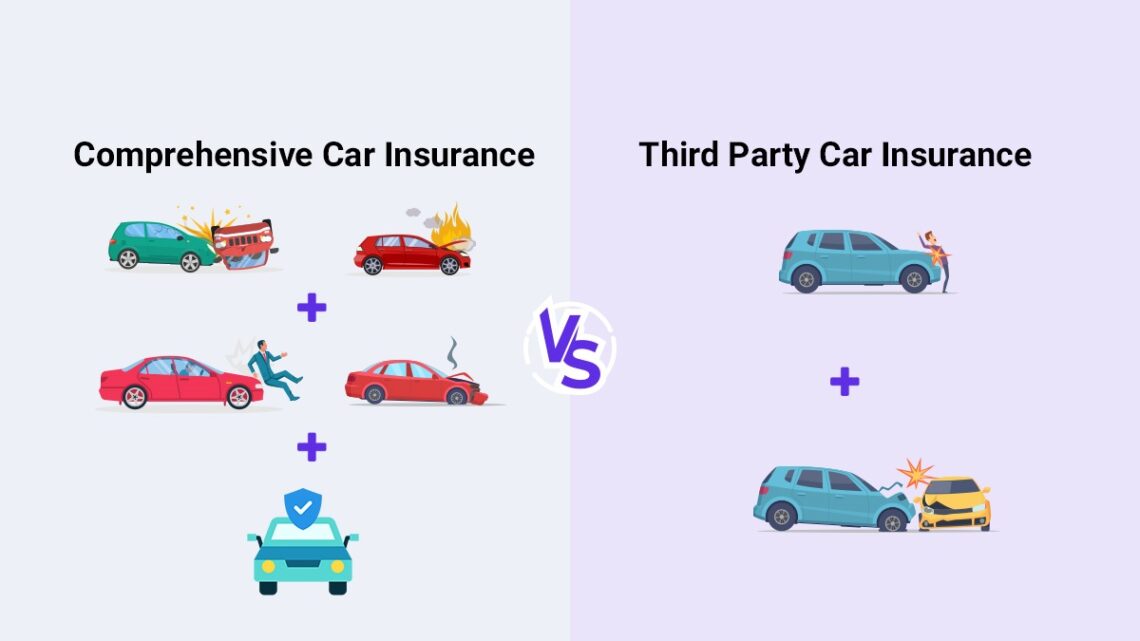

Third-party insurance covers damage or injury you cause to other people, their vehicles, or property. It does not cover your own car.

Key attributes of third-party insurance:

-

Covers liability to others

-

Excludes personal vehicle repair costs

-

Required by law in many states and countries

-

Lower premium compared to comprehensive

Example: If you accidentally damage another driver’s bumper, your insurer pays for their repair. Your own car’s damage is not covered.

What Is Comprehensive Car Insurance?

Comprehensive insurance protects against both third-party liabilities and damage to your own vehicle. It usually includes theft, fire, vandalism, and natural disasters.

Key attributes of comprehensive insurance:

-

Covers third-party damage and own car damage

-

Includes theft and non-collision incidents

-

Higher premium due to wider coverage

-

Often required for financed or leased vehicles

Example: If a storm damages your car or if it is stolen, comprehensive insurance pays for repairs or replacement.

How Do Costs Compare Between Third-Party and Comprehensive Insurance?

The main difference lies in coverage scope and premium amount.

| Policy Type | Average Cost (Estimate) | Coverage Scope | Best For |

|---|---|---|---|

| Third-party | Lower (budget-friendly) | Only others’ damages | Older cars, minimal driving, cost-cutters |

| Comprehensive | Higher (full coverage) | Own car + third-party + extra risks | New cars, financed vehicles, daily commuters |

General trend:

-

Third-party premiums are 20–40% cheaper than comprehensive.

-

Comprehensive can save money long-term if car repair costs are high.

Which Factors Affect Insurance Cost the Most?

Insurance companies use risk-based pricing. Both policy types are influenced by several attributes.

Key cost factors:

-

Car value – Expensive cars increase comprehensive premiums.

-

Driver profile – Age, driving history, and experience impact pricing.

-

Location – High-theft or accident-prone areas raise costs.

-

Usage – Daily commuting increases risk and premiums.

-

Add-ons – Roadside assistance, rental coverage, or glass cover increase cost.

When Should You Choose Third-Party Insurance?

Third-party cover is suitable when:

-

You drive an older vehicle with low market value.

-

You need basic legal compliance at minimal cost.

-

You drive rarely or only in low-risk areas.

When Is Comprehensive Insurance the Better Option?

Comprehensive cover is ideal when:

-

You own a new or financed vehicle.

-

You drive daily or in high-traffic areas.

-

You want financial protection from theft, fire, or natural disasters.

-

You seek peace of mind with broad coverage.

Expert Insight from Lori Wray, AAI

Insurance specialist Lori Wray, AAI advises that drivers should not evaluate cost alone. She highlights that repair bills after accidents or theft often exceed the savings from lower premiums. For many drivers, comprehensive insurance offers better long-term financial security despite higher upfront cost.

How Can You Estimate Your Car Insurance Premium Accurately?

The easiest way to compare real costs is by using a car insurance calculator. It allows you to input your car details, driver profile, and location to generate tailored quotes.

Try the Matrix Insurance car insurance calculator to estimate your premium instantly.

Final Thoughts on Cost Comparison

Third-party insurance costs less upfront but offers limited coverage. Comprehensive insurance costs more but shields you from high repair expenses and unpredictable risks. The right choice depends on your car’s value, usage, and financial risk tolerance.