Did your client ask you for a Certificate of Insurance? If you have no idea about it and are wondering what a certificate of insurance is, then it’s time to stop wondering and familiarize yourself with this document. Because you need it for your future contract and business dealings as well, not for just this existing deal.

Today, we are going to tell you what this certificate is, who needs it and how you can get it. So, it’s time to find out everything about COI.

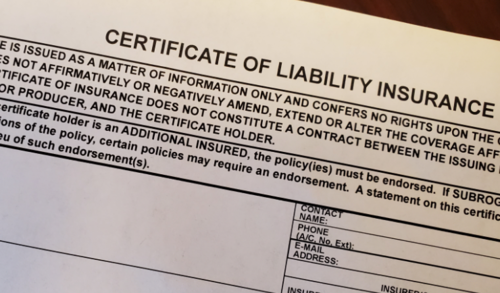

What is a Certificate of Insurance?

As the name explains it a bit, it’s a document that serves as legal proof of your insurance policy. This document is issued by your insurance company and broker. A COI verifies the existence, details, and condition of your insurance policy.

Normally, when you buy an insurance policy, you will get this policy in writing. This copy provides all the information related to your policy such as the policy condition, coverage details, annual premium, etc.

But this policy copy comprises tons of pages and legal language is difficult to understand. Thereby, many times policy holders ask for a certificate of insurance COI. Other times, insurance companies already issue them. This document provides key details in an easy-to-read format. This document highlights the following details

- Policyholder’s name

- The carrier’s name

- Policy number

- Coverage limit and deductibles

- Effective date and expiration date

- Contact number of insurer

- The type of coverage it provides

Depending on your policy type, it may contain some more details.

How do Certificates of Insurance (COI) Work?

This document is a must in a situation where liability is of great concern from a business context. A certificate of insurance provides proof of insurance coverage in that scenario.

When small business owners and contracts get liability insurance, they always ask their insurer to issue them a COI. This will protect their business against liability for workplace injuries and accidents.

If they don’t have a COI, they won’t be able to win any business contracts. It’s because the client won’t take the risk of hiring an uninsured contractor. Accidents can happen at any time and the client wants to know that the contractor has liability insurance that provides them coverage against substandard work, injury or damage.

Why Do Business Owners and Contractors Keep Certificates of Insurance?

There are several reasons to keep this certificate but here are two main reasons:

Proof of Insurance Status

Whenever clients hire a new company or contractor, they want to see proof of insurance. They are only interested in hiring insured vendors or contractors. When a contractor has an insurance policy, it means that it will provide coverage in case of an accident in the workplace or damage to property that happens during a project.

This liability insurance helps your client manage risks associated with a project. Thereby, they will always request proof of insurance status and you can provide them with a Certificate of insurance. Now if you are a business person who needs to hire a subcontractor or vendor then you will request their Certificate of insurance. The purpose of this request is to check what their insurance status is and understand the amount of coverage.

Easy Access to All Policy Information

No one has the time and energy to dig deep into multiple pages of the insurance policy. Thereby, a COI is here to help. It will answer all the main questions in the simplest form.

Review Coverage of Each Party

Another reason to request a certificate of insurance from the insurance company is to review the coverage of each party before signing any contract. Here is how you can analyze an insurance policy.

When you are going to work on a project then your client needs COI to check the current coverage status. If your client needs to be listed as an interest then your insurer will handle this matter. They will add your client to the policy and the COI.

At one glance, everyone can check the coverage details and make changes when needed. However, it’s important to note that COI is not a guarantee of insurance at all. It only showcases all the policy details that are valid on the date it is issued. In case a policyholder doesn’t have the policy at the moment and due to nonpayment then this certificate won’t showcase this detail.

Therefore, if you are planning to hire a contractor or vendor, it’s better to ask for a COI of the current date. You can directly get this certificate from the insurer. You need to access an updated COI to ensure that all the things written on it are still valid.

How To Obtain a Certificate of Insurance (COI)?

If you are a business owner or contractor who has purchased liability insurance from Matrix Insurance then you can get a COI from us by contacting us as and when you need. Normally, you get a COI when you buy a new policy but if you need a revised or new copy, you can ask us.

If you are hiring a contractor for your new project or simply you are a client who hires a company, then you need to request a COI from the insurer of your contractor or company. Once you obtain a COI, you need to validate its key information before signing any contract.

Always double-check that:

- The name of the policyholder matches the name of the person or company you are going to work with.

- The policy is valid and won’t expire during or after your project completion date

- The amount of coverage is sufficient

- The policy itself is valid

- The insurance company is legitimate

- Another important thing to check is additional interests. Read all the interested parties of this policy and request changes in interest if you need to.

Wrap up

A certificate of insurance is an essential document because it serves as legal proof that you have sufficient insurance coverage. You need them to win the trust of your clients and continue working smoothly on a project. Whenever you get your business insurance, ensure that liability insurance is a part of it or you can buy it separately. It protects you and others in case of any accident or damage.

Are you looking for the best business insurance in USA for your small business? If yes, then get it from Matrix Insurance. We also issue a Certificate of Insurance for every new policy or you can request a revised copy as and when you need. Call us today at (706) 310-0000

Related Post

What is Inland Marine Insurance?

Many businesses think that standard commercial property insurance is good enough for their business until the time cargo theft or collision leads to the loss of their specialized high-valued assets and properties in moving. In that scenario, your commercial property insurance doesn’t offer coverage and your insurer probably asks you if you have inland marine […]