Car insurance premiums often look confusing, but every cost has a reason. Insurance companies calculate rates by combining risk factors, coverage options, and vehicle attributes. Understanding the breakdown helps you see what you pay for and how to reduce it.

What is a Car Insurance Premium?

A car insurance premium is the amount you pay an insurer to provide coverage. Companies calculate it based on probability of risk, type of coverage, and claim history. Payments can be monthly, quarterly, or annually.

Example:

-

Annual premium: $1,200

-

Monthly payment: $100

Which Factors Affect Your Car Insurance Premium?

Several measurable factors influence the final price. Insurers assign weight to each.

| Factor | Influence on Premium | Example Impact |

|---|---|---|

| Driver Age | Young or new drivers pay more | A 20-year-old may pay 80% higher than a 40-year-old |

| Driving Record | Accidents or violations increase costs | One speeding ticket can raise rates by 15% |

| Vehicle Type | Luxury or sports cars raise risk | A sedan costs less to insure than a sports car |

| Location | Urban areas have higher accident/theft risk | City drivers may pay 25% more than rural drivers |

| Credit Score | Lower scores correlate with higher claims | Poor credit may increase premiums by 20% |

| Coverage Limits | Higher coverage adds cost | $100,000 liability limit is cheaper than $300,000 |

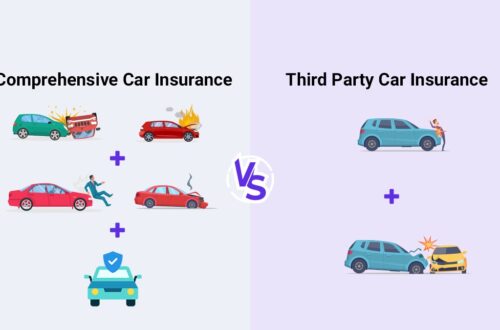

How Do Coverage Types Shape the Premium?

Coverage determines protection level. Each type adds a cost component to your premium.

-

Liability Coverage → Pays for damage you cause. Required by law in most states.

-

Collision Coverage → Covers your car in an accident. Increases premium by 20–40%.

-

Comprehensive Coverage → Protects against theft, fire, and natural disasters.

-

Uninsured Motorist Coverage → Protects against uninsured drivers.

-

Medical Payments / PIP → Covers injuries to you and passengers.

Example Premium Breakdown (Annual, $1,200 total):

-

Liability: $400

-

Collision: $350

-

Comprehensive: $250

-

Uninsured Motorist: $100

-

Medical Payments: $100

Why Do Risk Profiles Matter in Car Insurance Premiums?

Insurance companies use risk profiles to predict claim likelihood. A driver with safe history pays less than someone with multiple violations.

-

Low risk: Safe driver, clean record, suburban area → $850 premium

-

High risk: Speeding tickets, urban area, high-value car → $2,200 premium

How Can You Lower Your Car Insurance Premium?

Insurers reward behaviors that reduce risk. Practical steps can reduce premiums significantly.

-

Maintain a clean driving record → Avoid traffic violations.

-

Choose higher deductibles → Accept more out-of-pocket costs.

-

Bundle insurance → Combine auto and home for discounts.

-

Use telematics devices → Prove safe driving habits.

-

Compare quotes with tools like a car insurance calculator.

Expert Insight from Lori Wray, AAI

Lori Wray, AAI emphasizes transparency in premium breakdowns. She explains that many drivers overlook optional coverages or discounts. Reviewing your policy annually with an insurance advisor helps optimize costs.

Example Case Studies

Case 1: Young Driver

-

Age: 19

-

Car: 2019 Honda Civic

-

Record: 1 speeding ticket

-

Annual Premium: $2,500

-

Breakdown: Liability $900, Collision $800, Comprehensive $500, Other $300

Case 2: Middle-Aged Homeowner

-

Age: 42

-

Car: 2022 Toyota Camry

-

Record: Clean

-

Annual Premium: $1,100

-

Breakdown: Liability $400, Collision $300, Comprehensive $250, Other $150

Why Use a Car Insurance Premium Calculator?

A premium calculator provides estimated costs before purchase. It helps compare coverage scenarios. Entering details like age, car model, and driving history generates accurate quotes. Try the auto insurance calculator to see how factors apply to you.

Key Takeaways

-

Premiums are calculated by risk, vehicle, and coverage.

-

Liability, collision, and comprehensive form the largest cost portions.

-

Risk profile and location strongly impact price.

-

Tools like premium calculators and expert advice from Lori Wray help optimize costs.